Global Membrane Separation Market Research

Persistence Market Research Released New Market Report on “Global Market Study on Membrane Separation: Water & Waste Water Segment to Witness Highest Growth by 2019”.

The global membrane separation market was valued at USD 19.0 billion in 2012 and is expected to grow at a CAGR of 10.8% from 2013 to 2019, to reach an estimated value of USD 39.2 billion in 2019.

Mandatory government regulation and increasing demand for clean processed drinking water is propelling the water processing industry to provide the public with clean processed drinking water free of impurities. This is providing growth opportunities for the water treatment industry.

Mandatory adherence to environmental standards such as the Clean Water Act especially in areas with water scarcity have influenced the demand for better water treatment technology, including membrane separation technology. Shifting from chemical to physical treatments is also a major driver as chemical treatments are perceived as environmentally unclean technologies with associated disposal costs. In addition, awareness of water scarcity has influenced the demand for water reuse in water stressed areas.

Worldwide industrial expansion and growing population are propelling the demand for better water treatment technology, providing growth opportunities for the global market for membrane separation technology. Additionally, the oil and petroleum industry is well established in the gulf and European countries such as Italy and Germany which use membrane separation technology for liquid separation. Expansion of such industries is expected to increase the overall demand for membrane separation technology.

Membrane separation technology is bifurcated into four major processes, microfiltration, ultrafiltration, nanofiltration and reverse osmosis. Microfiltration dominates the market with more than 35% of the global market share in 2012. Whereas water and wastewater dominates the end-user market with 36% of the global market shares in 2012. The global membrane separation market grew from USD 19.0 billion in 2010 to USD 21.2 billion in 2013.

The european membrane market (the largest in 2013) is expected to reach USD 13.8 billion in 2019, growing at a CAGR of 9.6%. In 2012 the water and wastewater sector was the major end-user of membrane separation technology and this is expected to increase at a CAGR of 11.1% during 2013-19.

The membrane separation market is fragmented with several players in the market supplying membrane separation products to the end-users (water and wastewater, industrial and healthcare) in the market. Most of the companies produce different types of membrane products such as microfiltration, nanofiltration, ultrafiltration and reverse osmosis and sell them globally.

Major companies operating globally and manufacturing all four products are Evoqua Water Technologies, Pall Corporation, Koch Membrane Systems Inc., Merck Millipore, Degremont SA, Dow Chemical Company, GEA Filtration, 3M Company, Nitto Denko Corporation and Veolia Environnement.

Featured articles and news

Tackle the decline in Welsh electrical apprenticeships

ECA calls on political parties 100 days to the Senedd elections.

Resident engagement as the key to successful retrofits

Retrofit is about people, not just buildings, from early starts to beyond handover.

What they are, how they work and why they are popular in many countries.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

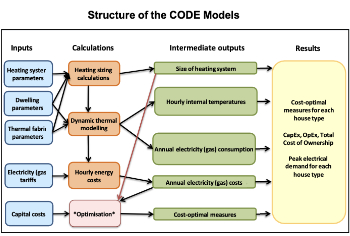

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.

The Warm Homes Plan details released

What's new and what is not, with industry reactions.

Could AI and VR cause an increase the value of heritage?

The Orange book: 2026 Amendment 4 to BS 7671:2018

ECA welcomes IET and BSI content sign off.

How neural technologies could transform the design future

Enhancing legacy parametric engines, offering novel ways to explore solutions and generate geometry.

Key AI related terms to be aware of

With explanations from the UK government and other bodies.

From QS to further education teacher

Applying real world skills with the next generation.

A guide on how children can use LEGO to mirror real engineering processes.

Data infrastructure for next-generation materials science

Research Data Express to automate data processing and create AI-ready datasets for materials research.

Wired for the Future with ECA; powering skills and progress

ECA South Wales Business Day 2025, a day to remember.

AI for the conservation professional

A level of sophistication previously reserved for science fiction.